Reports Identify Regulatory Coordination Key to Optimizing Cross-Border Electricity Trade in South Asia

South Asia is one of the fastest growing regions in the world, possessing substantial generation potential yet nevertheless plagued by electricity supply shortages. Open electricity trading across borders can help, but poor regulatory alignment between neighboring countries can stand in the way of success.

A series of three reports developed by the National Renewable Energy Laboratory (NREL) examines the regulatory coordination needed to enable Bangladesh, India, and Nepal to participate cost-effectively in cross-border electricity trading (CBET). A coordinated regulatory regime for CBET can help each country meet its growing energy demands, improve power system reliability across the region, and efficiently manage domestic renewable energy resources.

The reports are funded through the U.S. Department of State's Bureau of South and Central Asian Affairs Regional Connectivity Program. The program helps partner countries develop more robust regional energy markets, improve cross-border connectivity in South Asia, and expand renewable energy in the region through peer-to-peer collaborations, power system modeling, regulatory coordination, and improved data.

Flowing energy across international borders creates unique challenges.

"Cross-border electricity trading represents the nexus between technical potential and political reality," said Dr. David Hurlbut, senior researcher at NREL and the reports' primary author. "There is an additional level of complexity in harmonizing the sovereign decisions of different countries so they can be on the same page with respect to things like cost recovery, foreign exchange, investment risk, and the distribution of benefits. It’s about consensus, which requires vision and fair processes along with good technical information."

Importantly, the aim of the report series is not to recommend how Bangladesh, India, and Nepal should engage in CBET. Rather, the intent is to map out the major decision points and collaborative steps to assist each country's power system planners in developing a supportive institutional framework.

Market Drivers for CBET in South Asia

Regulators in India proposed major reforms to address inefficiencies in India's wholesale power markets in 2018. The reforms would move India's power system toward greater integration based on the principles of market-based economic dispatch, in contrast to its current patchwork of bilateral contracts and separate operating norms. While the reforms in India are still evolving, they could significantly accelerate CBET between India and other South Asian nations.

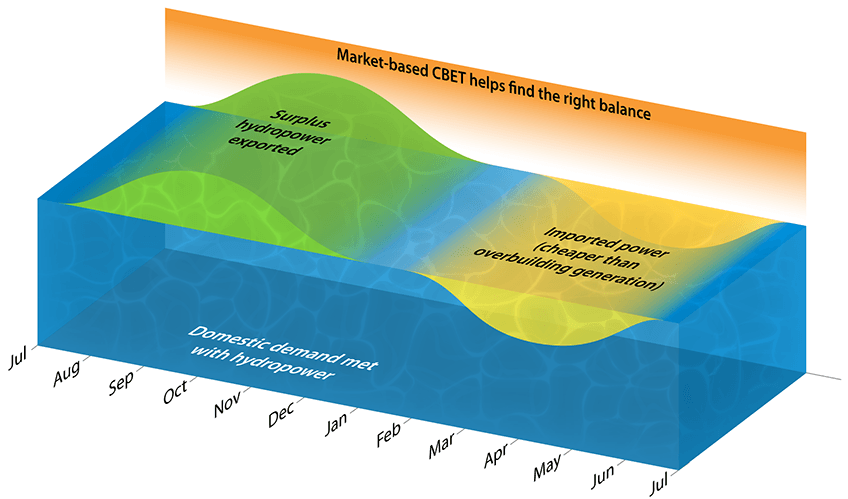

The implications of these market reforms could include the ability of Nepal to sell surplus hydropower to India and Bangladesh. For Bangladesh, participation in a dynamic wholesale power market could provide cost-effective energy alternatives at a time when its natural gas reserves are diminishing.

An Outline for Market Readiness

Each country's regulatory considerations are framed through three CBET transaction models:

- Tenant generation, in which a generator exports power to another country over a dedicated cross-border transmission line with little or no connection to the host country’s system

- Bilateral contracts, where power moves through both national networks and across transmission interfaces linking the two grids

- An integrated market exchange where cross-border trades and all other power flows are optimized simultaneously over a consolidated network.

The reports go on to lay out specific regulatory areas that Bangladesh, India, and Nepal might review to ensure a transparent shift to cross-border, market-based electricity trading. Among these decisions is jurisdictional clarity as to which agencies in each country decide specific topics such as transmission siting approval, standard data reporting requirements, registration, and the use of foreign exchange.

Additionally, the reports recognize each country's need to begin its transition toward market-based electricity trading by first performing an inventory of its own national electricity and foreign trade policies to identify potential gaps in existing laws. Further, monitoring important metrics such as price, volume, and transmission congestion can help regulators assess whether CBET outcomes are consistent with each country’s public interest. If they agree that an expanded and fully integrated electricity market would be in their best interests, the countries would also need to reach consensus on market governance and on the role of stakeholders.

Empowering Robust Private Sector Participation

Many country-specific factors come into play with greater CBET. Besides multilateral consensus, some actions might entail additional domestic legislation and internal coordination among various national agencies.

As Hurlbut further clarified, "the more clarity and transparency you have within regulatory guardrails, the more private investment can happen. Any degree of regulatory uncertainty will have a chilling effect on investment."

Decision-makers in Bangladesh, India, and Nepal have myriad concerns to manage when crafting their approach to CBET. These reports help map efficient regional planning by providing insights about institutional coordination necessary to ensure that cross-border, market-based electricity trading is successful.

Read the report series:

Regulatory Foundations for Cross-Border Electricity Trading: Bangladesh

Regulatory Foundations for Cross-Border Electricity Trading: India

Regulatory Foundations for Cross-Border Electricity Trading: Nepal

Last Updated May 28, 2025