Stellar Year for the Solar Market, at Home and Abroad

Spring 2024 Solar Industry Quarterly Update Highlights Significant Progress in 2023

The year 2023, according to National Renewable Energy Laboratory (NREL) analyst David Feldman, was a year of historic proportions in the solar power industry.

Four times a year, Feldman and a team of analysts and data experts from NREL and the U.S. Department of Energy (DOE) compile data for NREL's Quarterly Solar Industry Update. The quarterly update series, now approaching its 15th year, has grown from a small report NREL delivered to DOE about what Feldman describes as a then-niche market to a presentation about one of the fastest-growing sources of clean energy in the United States and beyond.

"It is an order of magnitude difference between when we started compiling analyst projections in 2009 and where we are now," Feldman said. "Solar has gone from a niche source of electricity to one of the key players in the energy ecosystem, not just in the clean power sector but for the whole energy sector."

One element of the quarterly update that makes it such a critical piece of NREL's work is its use of publicly available industry data from a variety of sources that would otherwise be difficult for some stakeholders to access.

The Quarterly Solar Industry Update provides analysis, visualizations, and contextualization on everything from solar photovoltaic (PV) module production and supply chains to electricity generation and end-use data. Data from 2023 shows rapid growth both in the rearview mirror and on the horizon.

A Brief Look at the Numbers

The Spring 2024 edition of the Quarterly Solar Industry Update paints a comprehensive picture of both what happened in solar markets through 2023 and what could happen from 2024 through 2050.

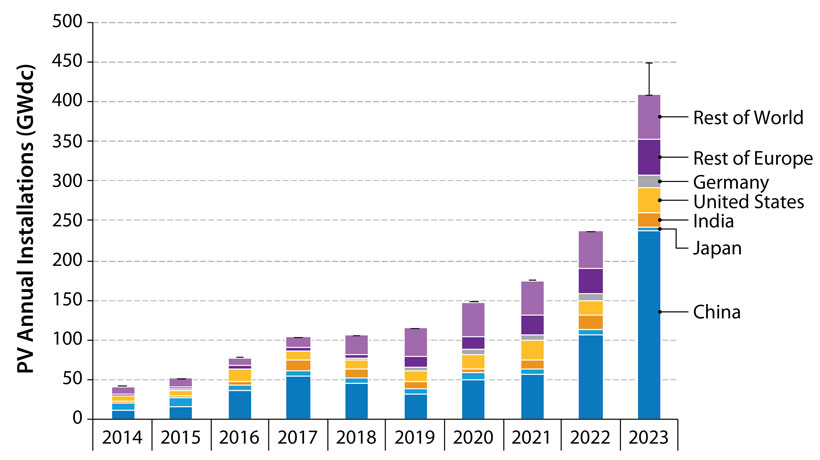

According to International Energy Agency reports, global PV installations increased dramatically, with up to 446 gigawatts of direct current (GWdc) connected. Globally, analysts project that by 2030 as much as five terawatts (TWdc) of PV may be installed, and up to 15 TWdc of PV could be installed by 2050. That is 66% more generation capacity than all the electric generation assets currently installed around the world combined. That much energy could simultaneously power about 200 LED lightbulbs for every human on Earth.

China dominated global PV deployment, making up roughly 60% of new installations, while the United States tallied the second-largest share of PV installations last year.

"Over the past 15 years, China has gone from being a leader in manufacturing to dominating many parts of the solar supply chain and being the key market for solar deployment as well," Feldman said.

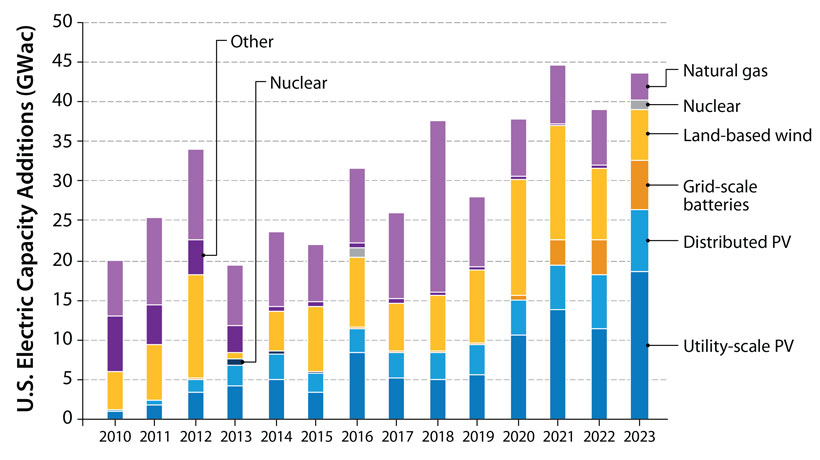

U.S. domestic PV deployment grew faster than ever. It represented more than half of new electricity generation capacity in 2023, with 32–40 GWdc of PV installed, depending on how installation dates are defined.

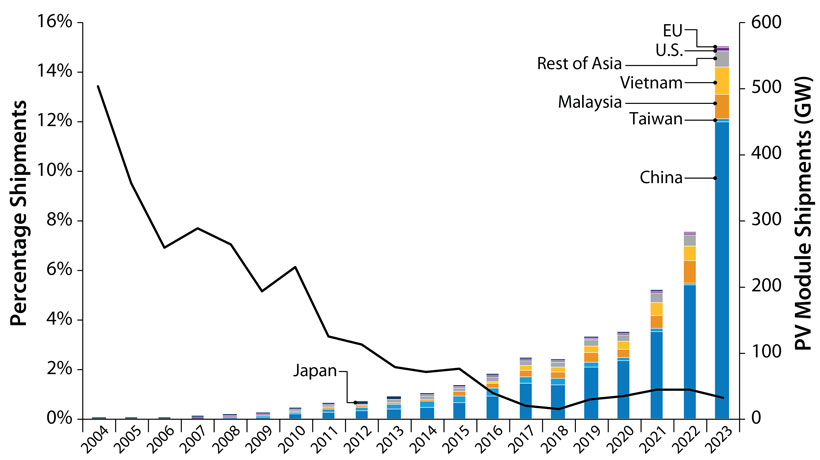

Another key piece of data showed the recent drop in global module prices has seemingly leveled off. In the first quarter of 2024, those prices remained around 11 cents per Wdc. However, in the United States, while average module prices dropped approximately 5% in the fourth quarter of 2023, they stayed about 140% higher than global pricing, at 31 cents per Wdc.

2023 was also a major year for PV manufacturing and shipping. Globally, shipments increased 100% year over year from 2022, reaching approximately 564 GW of PV modules shipped, according to Solar PV Market Research. The United States produced about 7 GW of PV modules last year as well. According to U.S. Census data, the United States imported 55.6 GWdc of modules, representing an 87% increase in imports from 2022.

"We're at a historic point where, if you look at all the new electricity generation capacity by different technologies that have come online since the dawn of the U.S. electric grid, solar, wind, and batteries are being installed at record levels, representing a real sea change in what the grid will look like in the future," Feldman said.

How the Data Informs Decisions

Historically, the Quarterly Solar Industry Update has provided a detailed look at the state of the solar industry to both DOE and industry stakeholders such as grid planners and developers. And now, through NREL's new dynamic data platform, readers can generate their own analyses and visualizations of the data collected from the Quarterly Update, tailored to their specific needs.

This bar chart, produced from data compiled by NREL researchers, shows the solar generation capacities of U.S. states, broken down by type of solar energy.

"It's gone from a one-way conversation to a format that allows stakeholders to communicate with the data by looking at the long-term trends and focusing on what is important to them," said Jarett Zuboy, an author of the update.

The Quarterly Solar Industry Update provides detailed, publicly available, solar-specific information on a regular basis, giving stakeholders at every level from small solar operators to state and federal entities a means to better understand the current state of the industry and trends within it.

"It's critical to have an intimate understanding of what is happening because there is a lot of noise out there," Feldman said. "The decisions we make now are going to have a long-term effect on what happens in the future."

Learn about NREL's energy analysis and solar energy research.